- Propose reducing the public deficit through a multi-year strategy with a viable approach that aligns with fiscal goals.

- Maintain public finances in order to prevent countries from being vulnerable to external shocks, like pandemics, and to support sustained economic growth.

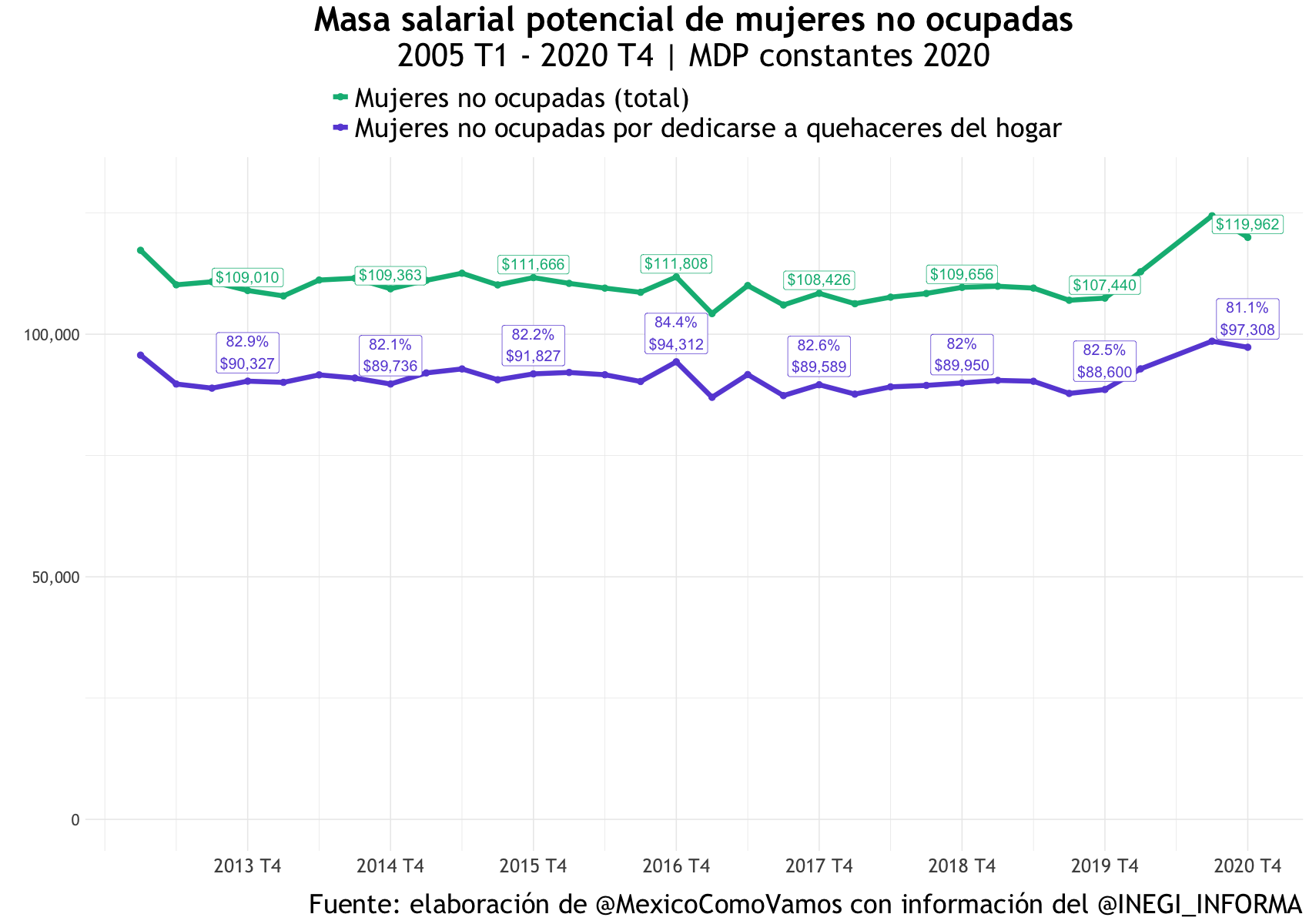

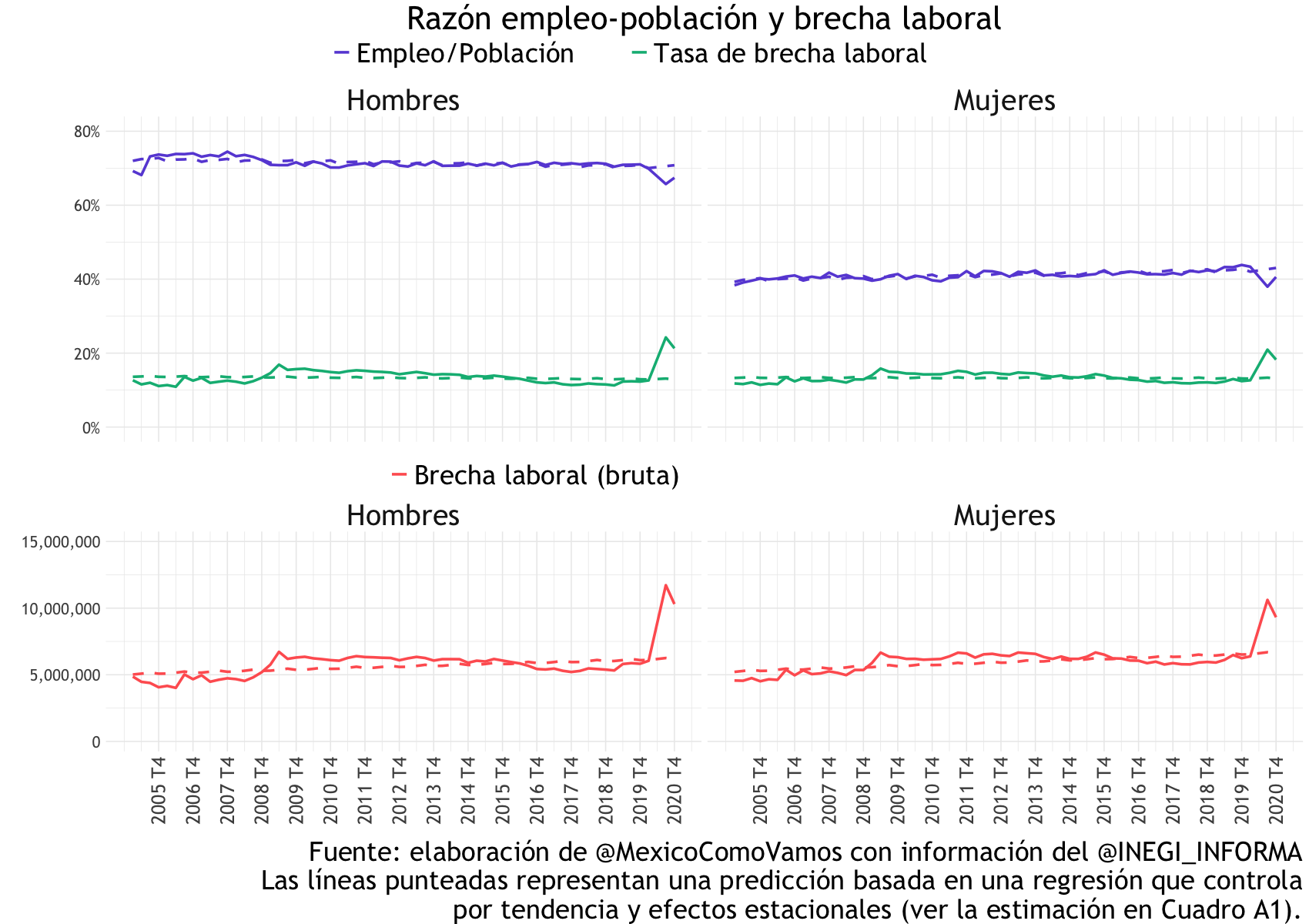

- Promote public spending that fosters sustained and inclusive economic growth, incorporating vulnerable groups into the formal economy.

- Implement transparency measures in tax collection so that everyone pays their fair share.

- Review public spending priorities in line with the country’s capacity to maintain sound public finances.

Check out our video 👀 where Kristalina Gueorguieva, managing director of the International Monetary Fund, answers Adriana García, Chief Economist in Mexico, ¿cómo vamos?, on how to reconcile the need for fiscal consolidation and inclusive spending.

What is fiscal consolidation?

According to the International Monetary Fund (IMF), fiscal consolidation refers to the measures implemented by a government to reduce the deficit and public debt through spending adjustments or revenue increases (Fiscal Monitor, October 2024).

What did MoF’s 2025 Pre-Budget let us know?

Timeline

Within one year.

Revenues

In 2025, an increase in revenues is expected compared to 2024, driven by a dynamic economy—even though it only grew 1.4% through Q3 2024 according to preliminary data—and greater tax collection efficiency. No tax reform is expected to increase rates on existing taxes or broaden the tax base.

Expenditures

In 2024, major infrastructure projects like the Maya Train will be completed, and they will not require subsidies for future operations, allowing the continued provision of existing public programs. At México, ¿cómo vamos?, we emphasize that the Trans-Isthmic Corridor of the Isthmus of Tehuantepec has yet to be fully inaugurated; connecting the south-southeast region with North America’s value chains should be a priority of the new administration to boost shared prosperity.

In 2025, non-programmable spending will decrease due to lower interest rates compared to 2024, although still at levels much higher than in the pre-pandemic period.

Meanwhile, programmable spending will decrease as infrastructure projects will have been completed.

Fiscal Targets

The Historical Balance of the Public Sector Borrowing Requirements (HBPSBR) is projected to remain stable at 50.2% of GDP.

For 2025, a fiscal consolidation scenario is anticipated, with a positive primary balance and a stable debt-to-GDP ratio.

The Public Sector Borrowing Requirements (PSBR) are expected to decrease from 5.9% of GDP in 2024 to 3.0% of GDP in 2025.

IMF Recommendation: establish a multi-year path to reduce the fiscal deficit without compromising economic dynamism.

Fiscal consolidation should aim to strengthen the stability of public finances, whether through increased revenue or greater efficiency in public spending, fostering macroeconomic strength as a necessary condition for dynamic economic growth and shared prosperity.

Takeaway: High public debt and low economic growth lead to increased inequality.

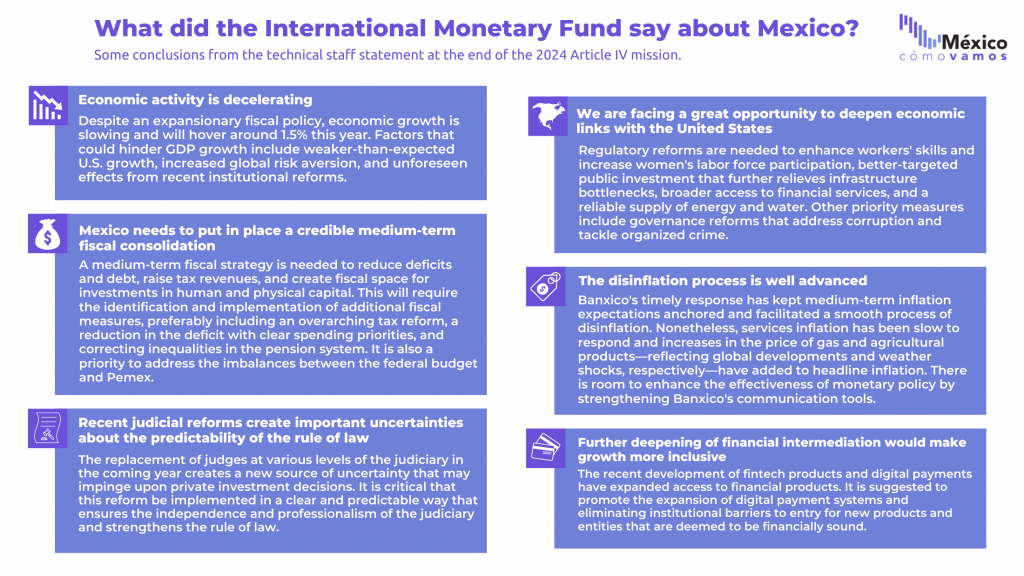

Staff conclusions at the end of the Article IV mission (2024)

For more information visit mexicocomovamos.mx Contact [email protected] and +52 55 7590 1756