On Monday, January 20, 2025, President Donald Trump begins his second term, marked by an isolationist rhetoric toward key trading partners, Mexico and Canada, who are essential for the United States to maintain its position as the leading global economy amid the challenge posed by China.

The outlook for Mexico is complex, as it faces immediate demands from its main trading partner on critical issues such as security, migration, and the growing presence of Chinese investment in the country. Additionally, trade policy remains President Trump’s preferred tool for exerting pressure.

In this publication we highlight:

- The Good. The deep interdependence of value chains in North America highlights the need to strengthen collaboration between USMCA partners to compete with the Asian giant.

- The Bad. Mexico’s public security challenges and the limited time for the implementation of the National Security Strategy.

- The Ugly. The announcement of mass deportations of Mexican and other Latin American migrants back to Mexico.

- The Opportunity. The innovation required to produce strategic components within the region, particularly in high-tech sectors, to reduce dependency on Asia.

The Good: North American integration

Since the signing of the North American Free Trade Agreement (NAFTA) in the 1990s and its evolution into the United States-Mexico-Canada Agreement (USMCA/T-MEC/CUSMA) in 2020, value chains in North America have developed a deep interdependence. The treaty is a unique and innovative tool of international trade that allows the vertical integration of the supply of necessary goods in the region, economic growth, and prosperity of the inhabitants of the trade bloc.

The success of the USMCA depends on respect for and compliance with its regulatory framework, which includes abiding by the resolutions of dispute panels. Examples of this are cases such as the rules of origin in the automotive industry filed by Canada and Mexico against the United States, or the panel on genetically modified corn, whose unfavorable resolution fell on Mexico.

In 2024, the combined economies of North America accounted for 29% of global GDP. The resilience of their value chains and the creation of quality jobs depend on collaboration among the three trade partners to enhance North America’s global presence in the face of competition from China.

Over the past two decades, North American economies have shown relatively consistent growth rates. However, since 2018, Mexico has begun to decouple from this trend, possibly due to a lack of legal certainty. This highlights the urgent need to strengthen the rule of law in Mexico to achieve higher growth rates and realign with the region.

For North America to remain the world’s most prosperous and competitive region, the United States depends on its trading partners: Mexico and Canada. Concerns about the growing U.S. trade deficit with Mexico should not focus solely on the amount but rather on how deeply integrated the region’s value chains are. That is, how self-sufficient is trade between members of the region to produce a final good. For example, components of a car can cross the borders of the three countries up to eight times before becoming a finished vehicle.

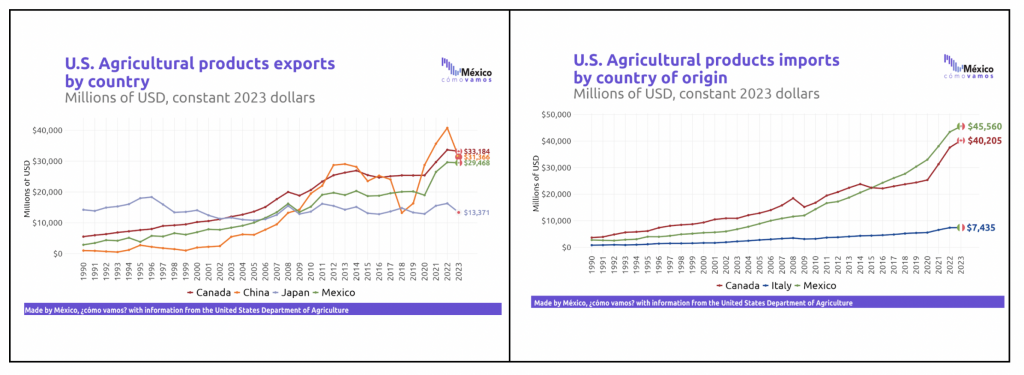

North America’s food security is intrinsically tied to the cooperation among its three trade block members. The United States sends most of its agricultural exports to Mexico and Canada, while its year-round availability of fresh fruits and vegetables relies heavily on imports from Mexico.

Under the USMCA regulatory framework, the first joint review represents an ideal opportunity to emphasize the deep commercial integration of the region and secure a positive outcome. The sunset clause of the USMCA (Chapter 34, Article 34.7) mandates that the Free Trade Commission (the Commission) conducts a review of the agreement’s operation in its sixth year. During this review, the parties can make recommendations and are required to declare in writing whether they wish to continue the agreement for another six years. A unilateral withdrawal by any party remains a possibility.

If all three parties agree to extend the USMCA until 2042, another review will take place in 2032, following the six-year review cycle established in the clause. However, if consensus is not reached by 2026, the parties will be required to conduct annual reviews until 2036, the original end date set when the agreement came into force (IMCO, 2024).

The Bad: Mexico’s security challenges

One of President Claudia Sheinbaum’s most pressing challenges is addressing the country’s insecurity with a regionally focused strategy closely tied to U.S. demands to combat cartels and tackle fentanyl production.

On October 8, President Sheinbaum unveiled the National Security Strategy, led by the Secretariat of Security and Citizen Protection, highlighting this issue as a top priority. This focus was evident during her first 100 days in office.

Public security is a prerequisite for shared prosperity, and progress under this strategy will be gradual. However, a major milestone was achieved with the historic seizure of over one ton of fentanyl in December 2024. Effective communication between the governments of Mexico and the United States will be crucial to tackling this issue. Additionally, active participation from Canada would not only reaffirm its commitment to regional security but also bolster the efforts of its two North American partners.

The Ugly: Mass Deportations announced by Trump and the lack of preparation of the National Institute of Migration

Mexico lacks a comprehensive strategy to address a potential migration crisis resulting from Donald Trump’s announcement of mass deportations. Budgetary constraints remain a persistent issue for the National Institute of Migration (INM, by its acronym in Spanish), which operates with limited resources. The 2025 Federal Expenditure Budget allocates only 1.7 billion pesos to the INM, a stark contrast to the over 30 billion pesos spent as of November 2024, according to data from the Ministry of Finance (SHCP, by its acronym in Spanish).

To date, no concrete measures have been announced to allocate funds of this magnitude to prepare for the reception of returning nationals and migrants from other countries in the coming months. This lack of planning raises concerns about the allocation and use of public funds, calling for greater transparency from Mexican authorities.

Efficient management of INM resources is essential to protect human rights, improve conditions for migrants, and streamline the processing of those seeking security and opportunities in Mexico.

The Opportunity: Driving innovation for advanced technology production in North America

North America remains a net importer of advanced technology products. Using the U.S. trade balance as an indicator, the region’s dependence on strategic inputs to stay at the forefront of global technology is evident.

Developing a robust supply chain for high-tech products, which offer higher value-added and better wages, could be the foundation for sectoral plans that foster shared prosperity in North America.

The Plan México represents an important step toward this goal, but significant efforts are needed to address challenges related to energy and water availability for production, workforce training, and strengthening legal certainty for investment.

Key data from U.S. imports in two critical digital economy subsectors—computer equipment and accessories manufacturing (334) and electrical equipment manufacturing (335)—highlight Mexico’s crucial role in regional supply chains. These findings must inform strategies to build a less China-dependent North America.

The economic and social challenges facing Mexico, the United States, and Canada are deeply interconnected. Collaboration among the trade partners is essential to ensuring that North America remains the most prosperous and competitive region in the world.

The United States-Mexico-Canada Agreement (USMCA) is a unique and modern trade instrument that has enabled North America to realize its potential as the world’s leading region. Only through cooperation among the three nations can their societies become more prosperous and North America maintain its global leadership against China.

Would you like to learn more about North American integration, the map of shared prosperity, and the integration of human capital through the USMCA?

Don’t miss out: