Fortalecimiento institucional

Es necesario mejorar el sistema organizacional de ahorro para el retiro con una sola institución rectora que facilite la portabilidad de las cuentas y simplifique los trámites administrativos:

- Coordinación organizacional

Que la política pública de ahorro para el retiro esté coordinada por un solo organismo que optimice la administración y gestión de la entrega de los beneficios a los individuos (CONSAR, 2022). De acuerdo con Azuara et al. (2019), se puede mejorar la gobernanza a través de la reducción de la fragmentación institucional existente, considerando una ley marco que establezca criterios que todos los programas pensionarios deban cumplir, integrando los distintos pilares y subsistemas y elaborando un modelo institucional que permita un adecuado diseño de política pensionaria. Es decir, que las instituciones públicas que otorgan pensiones como el IMSS, el ISSSTE, la CFE y Pemex estén coordinadas por un solo organismo que promueva la colaboración de las AFORES con los planes privados de ahorro, así como la portabilidad entre las cuentas de ahorro para el retiro.

- Portabilidad de las cuentas de ahorro.

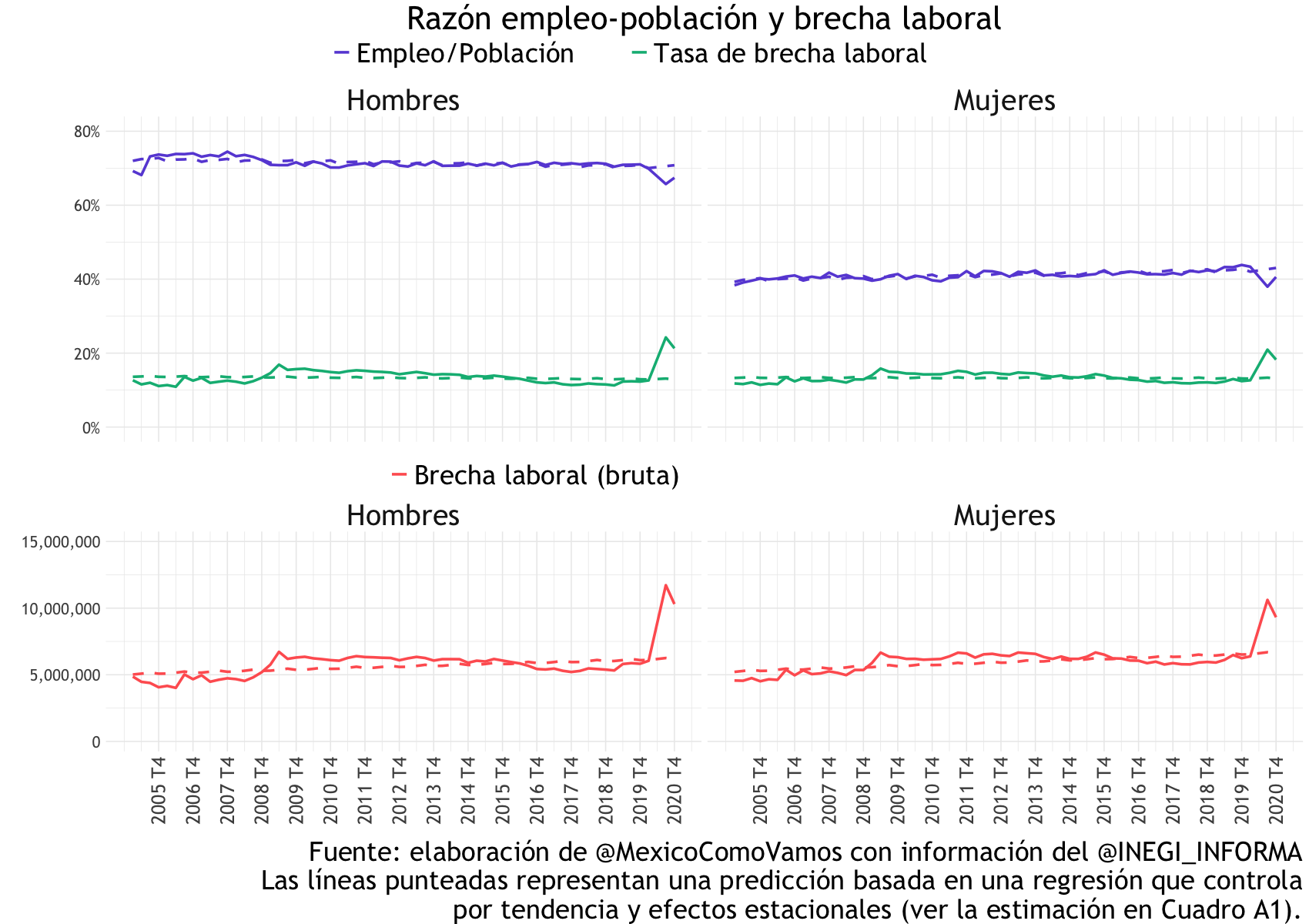

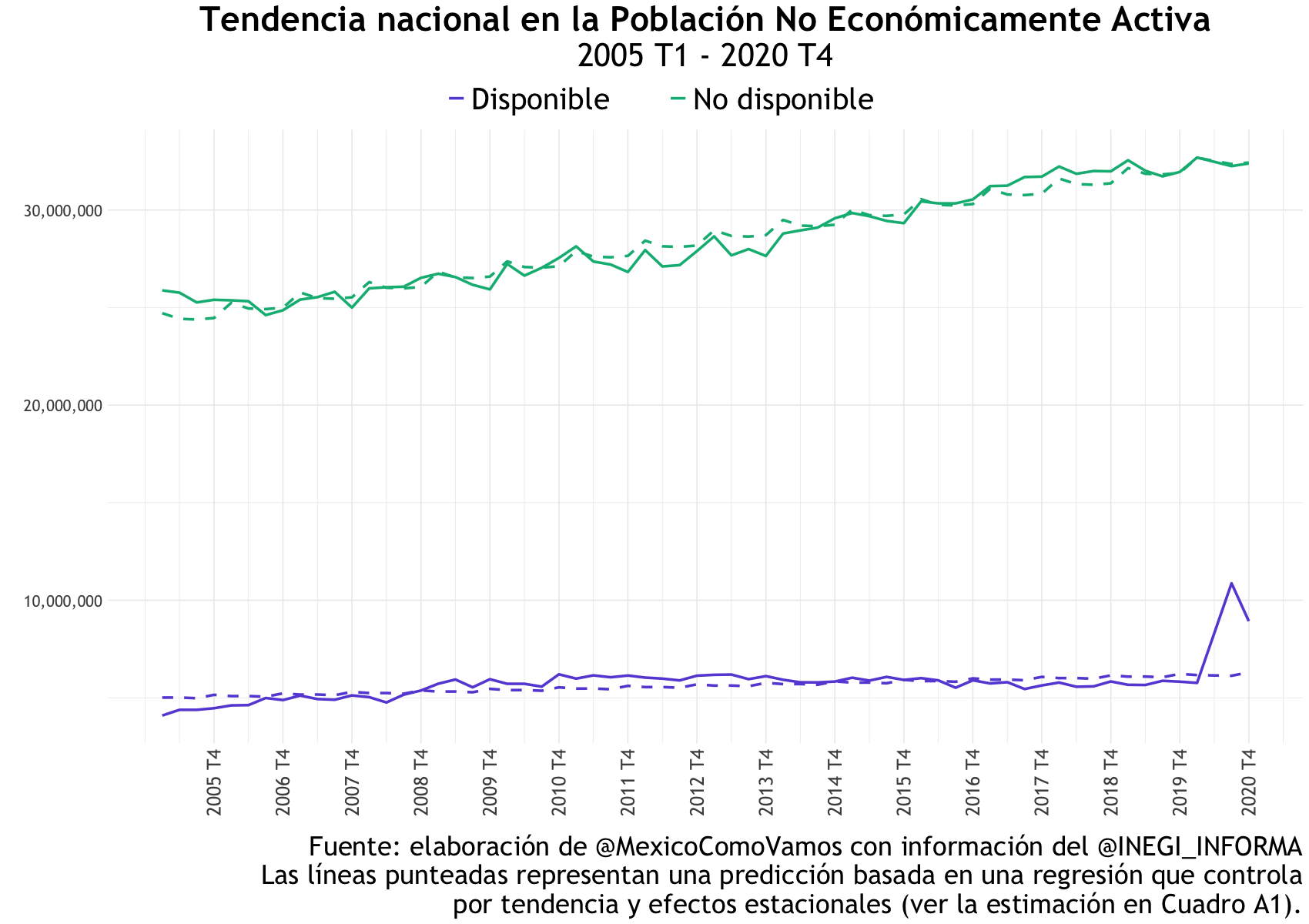

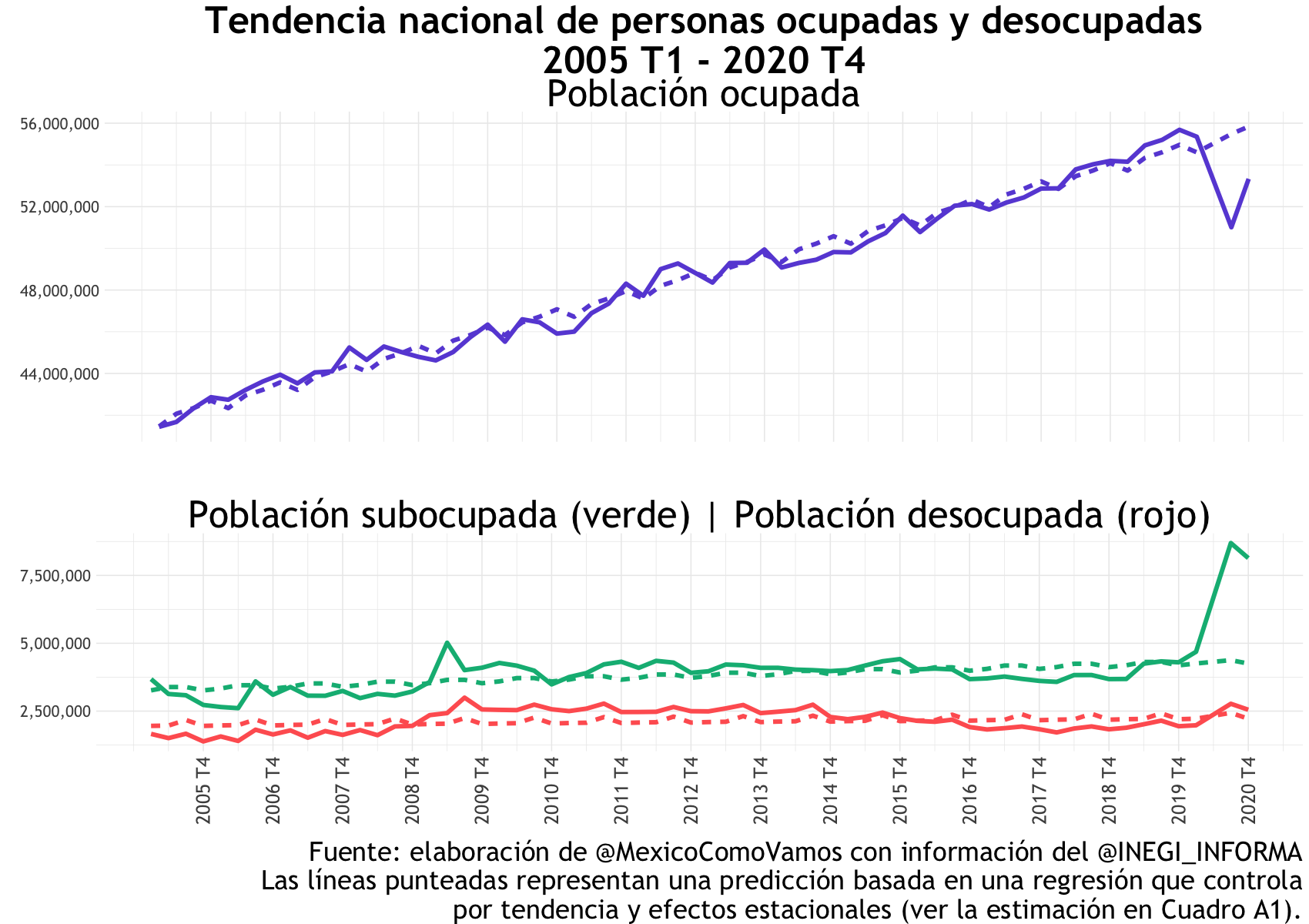

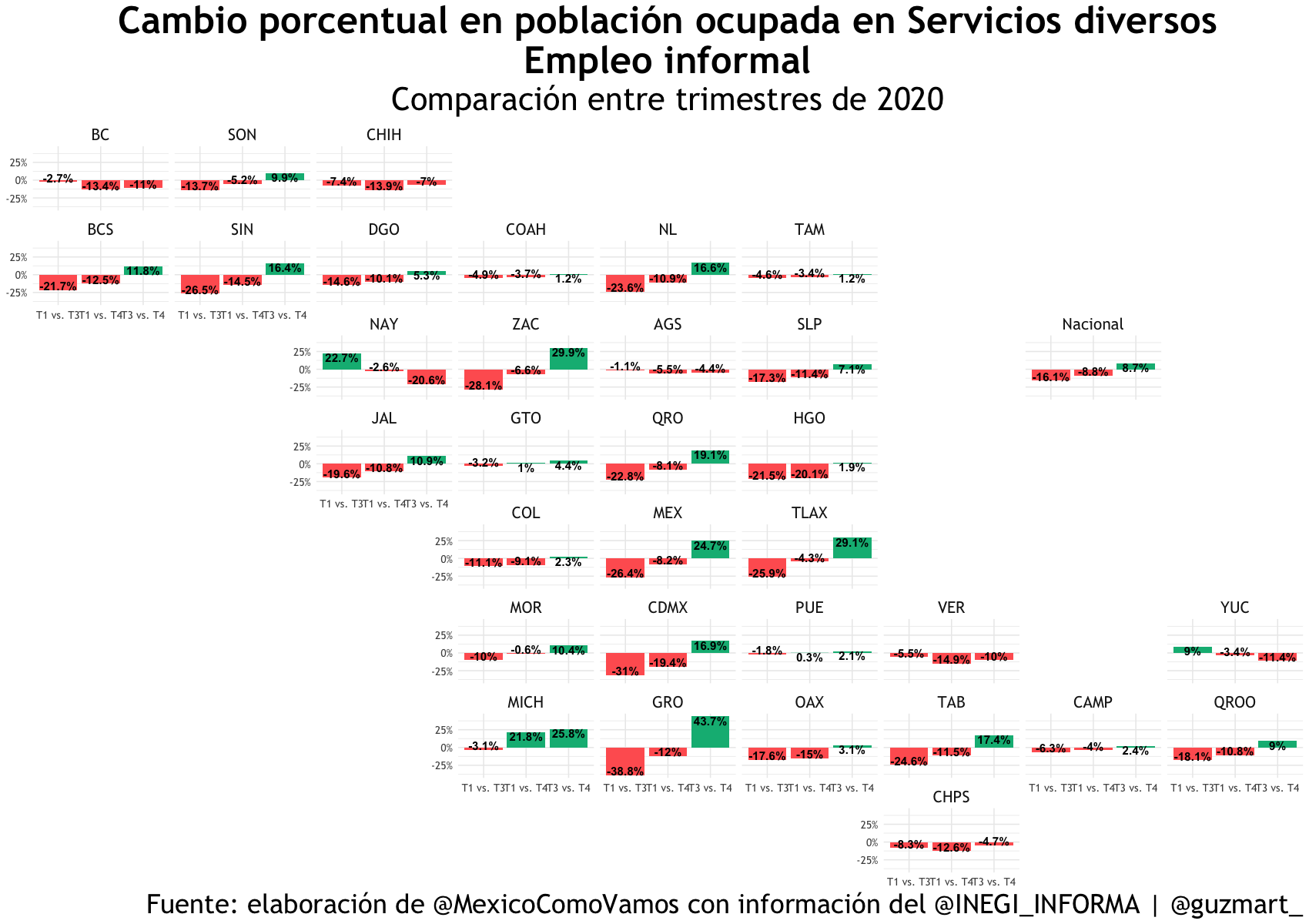

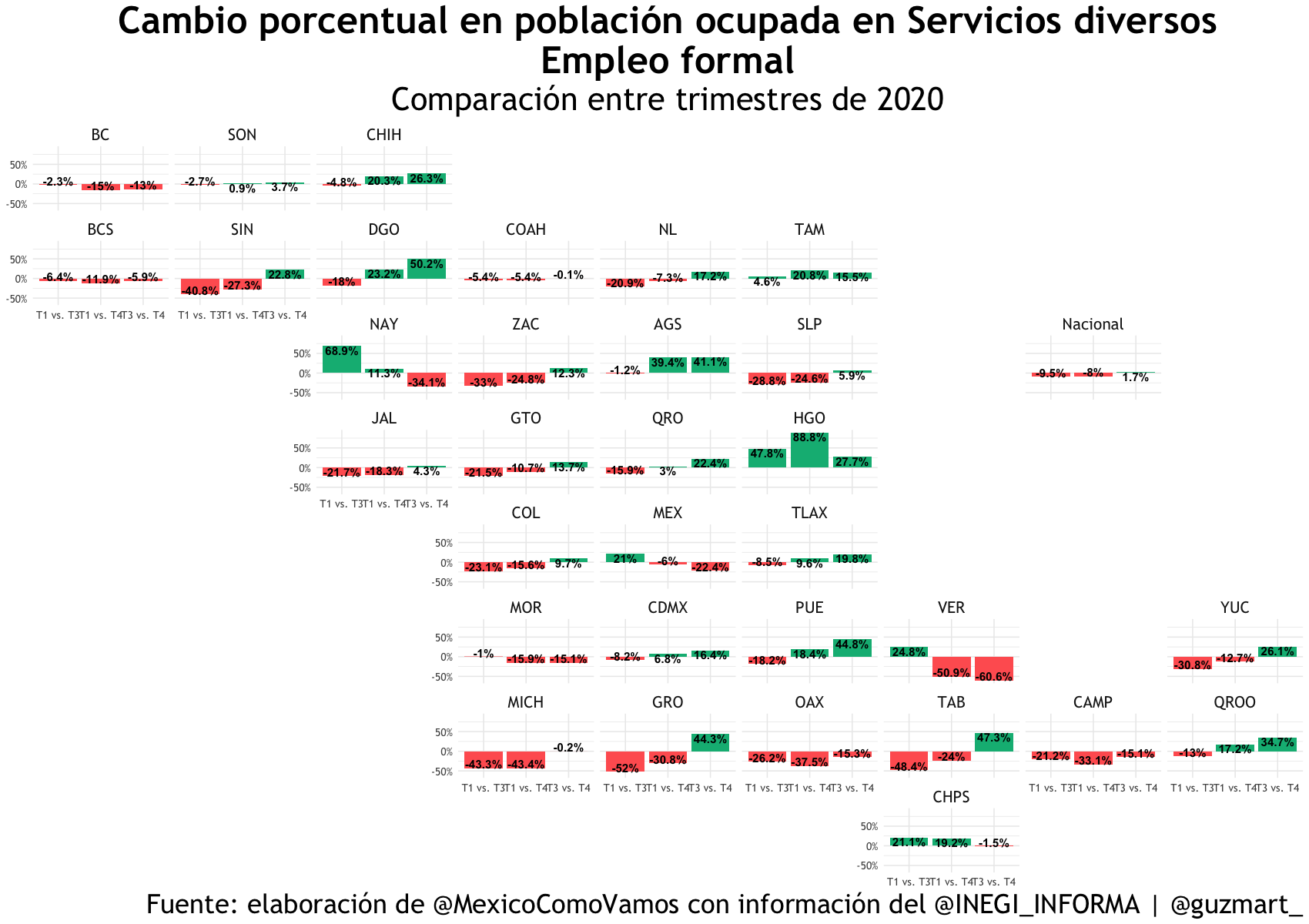

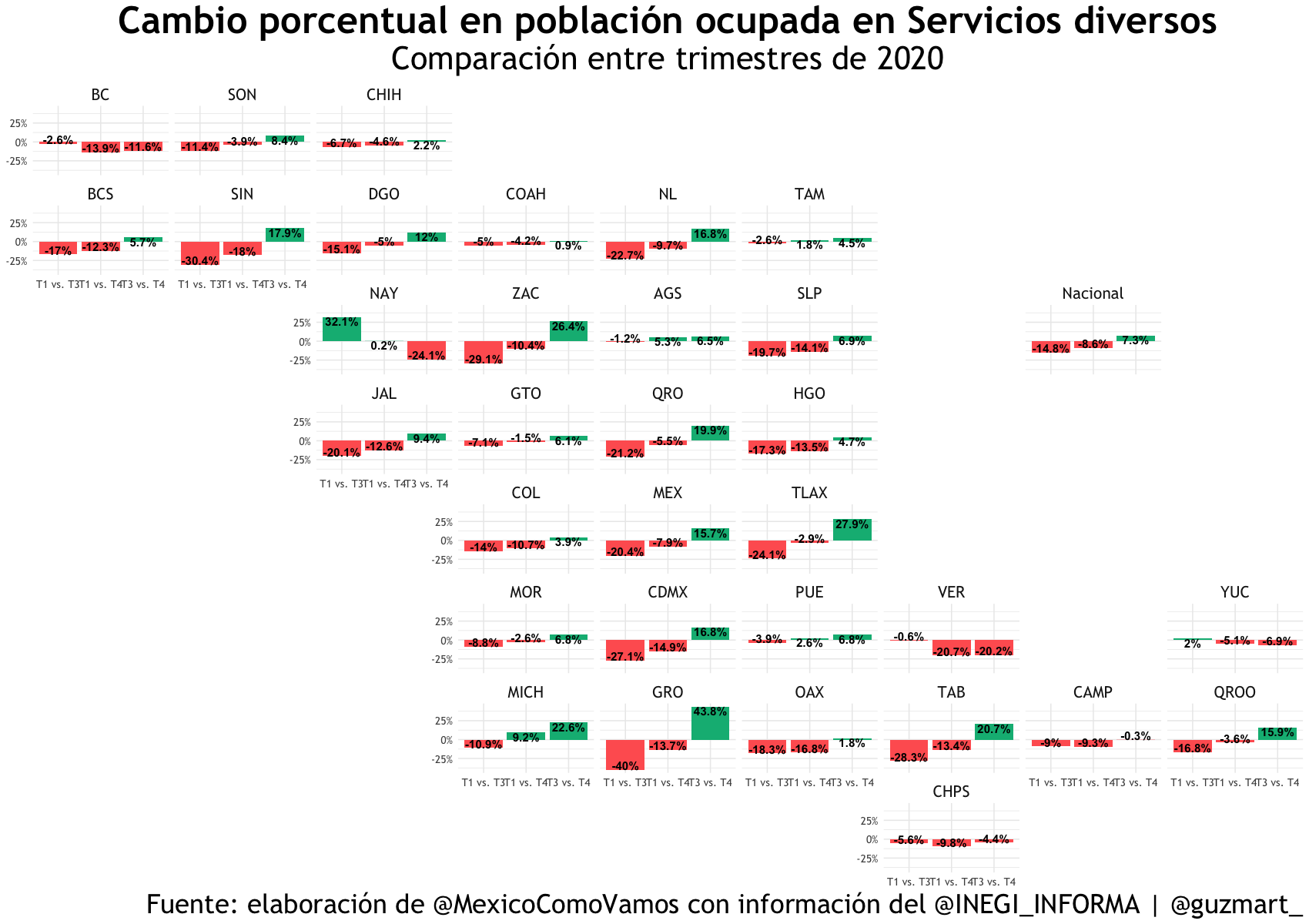

Dado que la población económicamente activa fluctúa entre las personas ocupadas y las desocupadas y, las personas ocupadas a su vez se dividen entre aquellas que trabajan en el sector formal y las que lo hacen en el sector informal, la fuerza laboral es cada vez más móvil y afecta la densidad de cotización de los trabajadores por lo que el ahorro para el retiro debe contemplar esta dinámica.

Una forma de hacerlo es con el diseño de la política pública de portabilidad de los ahorros, de contribuciones obligatorias o voluntarias en AFORES, fondos de inversión, seguros, PPR o PPP, deben premiar en todos los sistemas, tanto públicos como privados formando un Sistema Nacional de Pensiones (OCDE, 2015) que estaría coordinado por la institución rectora de la política del ahorro para el retiro. De esta forma, los trabajadores pueden acumular en una misma cuenta de ahorro las contribuciones obligatorias, el ahorro voluntario y los rendimientos que generen dichos montos sin interrupción a pesar de los movimientos de trabajo que realicen durante su ciclo de vida laboral. Además, se evita el riesgo de que los individuos retiren sus ahorros antes de la jubilación y comprometan los planes de las tasas de reemplazo futuras.

- Simplificación de los trámites administrativos.

Promover la simplificación de trámites administrativos disminuyendo los requisitos para abrir, cambiar o hacer aportaciones voluntarias en las cuentas de ahorro o para hacer portables los recursos para el retiro entre los diferentes jugadores del mercado que ofrecen este servicio. Dicho lo anterior, la coordinación institucional, la portabilidad de las cuentas y la simplificación administrativa son tres acciones simbióticas que mejorarían los resultados del ahorro para el retiro tanto para los jugadores del mercado como para los usuarios del sistema.